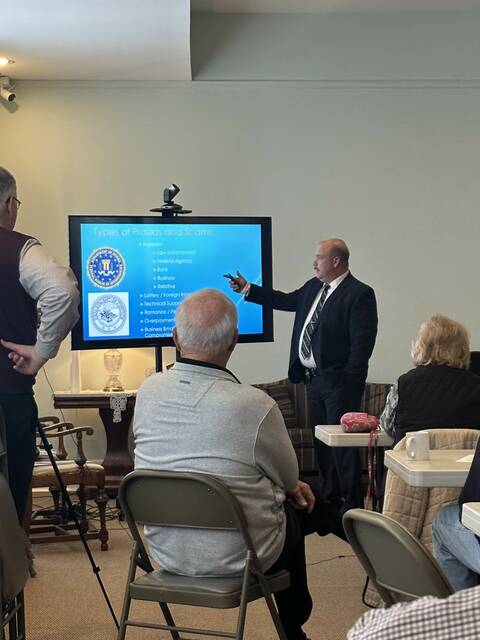

A workshop detailing several common scams was held on Saturday at the First Presbyterian Church in Maysville.

Saturday was the second in a two-part scam workshop series that gave an in depth look into scams such as imposters, lottery/foreign inheritance, technical support, romance/personal relationship, over payment/refund, social security and email compromised scams.

Maysville Police Department Det. Ryan Hull detailed each of these scams, the warning signs to consider and what to do if a person becomes a victim of one of them.

According to Hull, imposter scams can include law enforcement, federal agencies, banks, businesses and even relatives. When this occurs, the person answering the call should always verify who they are talking to on the other end.

Some imposter scams will include phone calls where the scammers tries to tell the person that their child or grandchild is in trouble or incarcerated and they need money to release the person.

“You know how you verify if that’s true? Hang up and call them. You can also have them on Life 360 so you can see that they’re not in Mexico, but actually on the avenue.”

He also said to never send gift cards to people who ask for them over the phone, because no legitimate company/person would ask for Google Play, Amazon cards or other gift cards.

“They pretend to be law enforcement,” he said. “No one is going to come and arrest you for money you might owe to someone. You might get served a paper, but no one is going to come and arrest you. If someone is suing you, you might have to go to court. But, if you, supposedly owe for a medical bill or a little bit of taxes, we are not going to come and arrest you.”

The social security scams usually include the scammer calling and asking the person to verify their social security number. If they give that information out, the scammer can use it to open credit in the person’s name or even affect the person’s social security.

The inheritance and lottery scams are less common because more people are educated about it, according to Hull.

Hull said that when people fall for these scams, they are being used to launder money.

“They’re laundering money through you,” he said. “They’re taking dirty money from cartels and terrorist organizations and they’re getting clean money from you. You’re supporting terrorism when you fall for this stuff. This isn’t Tom from down the street.”

One he discussed in detail about was romance scams.

“These are some of the saddest things I deal with,” he said. “People will create fake profiles or fake social medias. One of the saddest things about it is how they find their targets: obituaries. They know you’re now single. They have one person who just looks at obituaries. Months down the road, they’re looking at the person’s social media and find out they’re still single.”

According to Hull, people will often send money to these scammers.

“Money mules,” he said. “They’re being used as money mules. We call them that to be nice. If you’re laundering money, it’s a federal offense. Calling them money mules, we’re trying to put them in a different category because they are victims themselves. But until we get the law changed, they can be charged with a federal offense.”

Hull said there were several things people can be aware of before falling for a romance scam.

He suggested staying away from dating sites because it is easy to fake a profile. One of the most common scams is the scammer asking for money to be sent to them, but then the money never arrives and they ask for more money.

“The elderly people who are meeting people online usually just lose their money,” he said. “The young people who are meeting people online…sometimes they lose their lives.”

He said the email compromise scam is when a person will send an email that they have tried to make look similar to a legitimate email service.

He used an example from the Federal Bureau of Investigations. The real email address should always have @fbi.gov at the end of it.

During the workshop, he warned people to be weary about what they post on social media and to make sure all social media is private.

According to Hull, if a profile is public, scammers can see the person’s name, where they work, live, the names and photos of children, family members, vacation photos and more.

“We share everything,” he said. “Put it on private.”

He also discussed elderly abuse and the signs.

According to Hull, some of the signs of elderly abuse include:

— Not paying their bills

— Sizeable withdraws from accounts

— Physical harm

— Changes in personality

— Unusual new names on accounts

— Personality, hygiene changes

— Social isolation

—- Debt collector calls

— Strange medical bill charges

He also showed examples of forged documents that sometimes look similar while others look nothing like an official document.

Hull said if a person is a victim of fraud/theft/scams, they can report it to the local police or the FBI.

“Only one in four report,” he said. “If you report, we can take more stuff to Interpol and they’re more likely to intervene.”

In addition to reporting, Hull suggested everyone check their credit reports at least one per year to make sure nothing unusual has happened on their credit. If they suspect something is unusual, they can lock their credit for up to a year.

The full workshop can be viewed by visiting the First Presbyterian Church Facebook page at https://www.facebook.com/maysvillepcusa.org.